Lebanese depositors' money is being blown away by negligence, neglect

The depositors’ money crisis in Lebanon is one of the most severe economic and financial crises that Lebanon has witnessed in recent decades. This crisis has led to a significant erosion in the value of the Lebanese pound, the freezing of bank deposits, and the rise in poverty and unemployment rates

The features of the depositors' money crisis in Lebanon began to appear clearly in 2019, when the banking sector faced difficulties in meeting cash withdrawal requests, which led to the imposition of restrictions on cash withdrawals. The crisis worsened with the sharp collapse of the value of the Lebanese pound, which resulted in depositors losing a large part of their savings.

Several factors contributed to the exacerbation of the crisis, most notably the failure of successive Lebanese governments to implement the necessary structural economic reforms to address the roots of the crisis. The repercussions of this crisis are still ongoing, as the Lebanese suffer from a stifling living crisis and a deterioration in the level of public services.

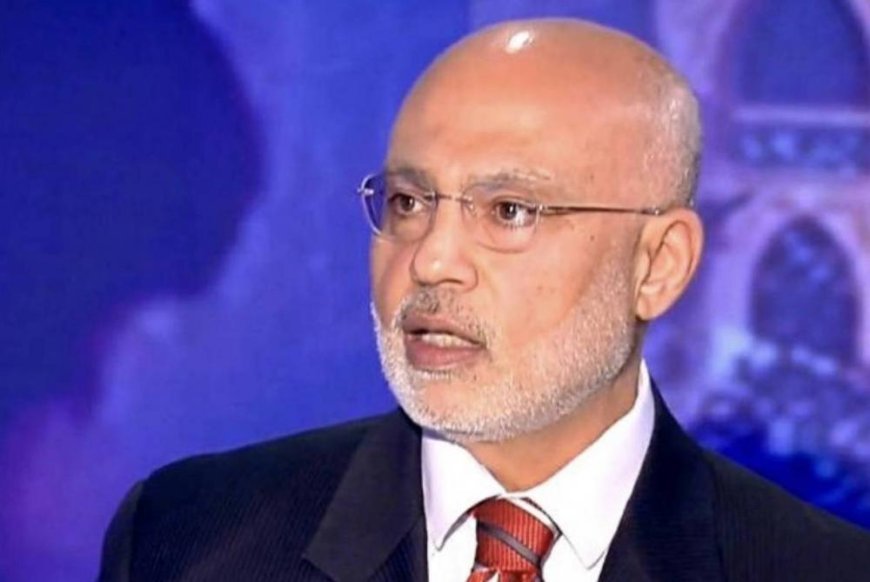

Banking risk expert and economic researcher Dr. Mohammad Fahili spoke to ANHA's agency in this context, and considered that the discussion about depositors' money took on an emotional dimension, as depositors want their money immediately through banknotes, and this method is not available in light of the economic reality that Lebanon is going through or through transferring money abroad, but there is no liquidity in the banks to secure these transfers.

Mohammad Fahili added: "From the point of view of the political authority, depositors' money has always been sacred, but on the ground we notice during the past four years that the value of deposits has collapsed and been hit by more than 85 to 90% due to the "haircut" or deduction from the value of bank deposits, because withdrawals were secured at an exchange rate below the dollar or logic."

Fahili believes that everyone should resort to logic in dealing with the deposit crisis, and attention should be focused on the Lebanese economy and all its components, "that is, on the Lebanese citizen and not just on depositors' money, and on Lebanese commercial institutions and not just on Lebanese commercial banks."

Fahili noted that the recovery of the Lebanese economy allows commercial banks to rebuild their liquidity, which helps them start serving the economy and thus enables depositors to secure the liquidity they need.

Attempts to revive the economy in Lebanon face failure

Several attempts were made by the Lebanese political authority to save depositors' money, but they failed. The "Capital Control" law, which was first discussed in April 2020, and after four years, it did not succeed and became, like its predecessors, one of the draft laws that failed in the parliamentary committees and the General Assembly of the House of Representatives, because these laws do not harmonize with Lebanese economic logic.

Fahili explained that the natural place for deposits is bank accounts, and what is required of the political authority is to reassure the depositor about his money, in a way that guarantees him the right to access his deposit so that he can secure the consumption bill, the hospital bill, education bill, and other living bills.

What solutions to save depositors' money in light of the deteriorating economic reality in Lebanon?

Speaking of banks, there are about 7 to 10 banks out of 45 commercial banks that have the ability to continue serving the economy, and they have succeeded in reconstituting sufficient liquidity to restore confidence in depositors and also to serve the economy, but the obstacle hindering the restoration of Lebanese economic stability is the lack of seriousness on the part of all political components, and the absence of the will to pass reforms, and this is the Lebanese reality, as the ruling authority always resorts to patchwork and superficial solutions, which puts the citizen in front of an unknown fate regarding his money and the harvest of his life

T/ Satt

ANHA